Most people are certainly aware that their super will help support their lifestyle in retirement.

But if you die, your super may also help support those you leave behind. Your super is likely to be one of the largest assets you’ll ever own and, therefore will potentially make up a large portion of your estate.

Consider then, what will happen to your super if you die. Specifically, that your super won’t automatically be paid out in line with your will. Unless you tell us who should receive your super when you die, it will be paid out at the ElectricSuper Board’s discretion.

By thinking about it now and making decisions, it can give you peace of mind, knowing your hard-earned money will go where you want it to in the event of your death. And it can also, subsequently, provide a level of reassurance to your spouse and family.

What is a beneficiary?

ElectricSuper members can nominate the beneficiaries they want to receive some or all of their benefit if they die. We offer what are known as “binding nominations of beneficiaries”, which is quite the tongue twister. Let’s break that down:

Binding |

means the Board is legally bound to follow your valid written nomination of beneficiaries form instructions, unless they are legally not able to do so |

Nomination |

means your choice, or who you nominate to receive your benefit |

Beneficiaries |

means the person or people will receive your super benefit if you die. |

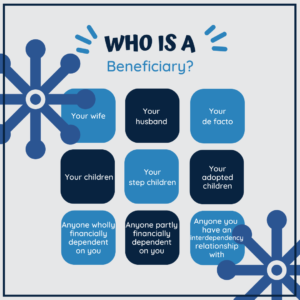

So who is a beneficiary?

Basically, your beneficiary (or beneficiaries) must be classed as a dependant under superannuation law to receive some of your super or they must be your legal personal representative (the executor of your will) .

A dependant includes:

- Your spouse (married, de facto)

- Your children (also including step-children, adopted children)

- Anyone wholly or partly financially dependent on you

- Any person you have an interdependency relationship with

If you nominate anyone who fits into any of these categories as a beneficiary, they will receive some or all of your super benefit if you die (if the nomination is accepted and valid and there is no legal reason the nomination can’t be honoured).

You can also choose to nominate your legal personal representative instead of, or in addition to, your dependant(s). This is the person who will act as the executor or administrator of your estate.

And you can split your super balance between your nominated beneficiaries in any percentages you choose (as long as it adds to a total of 100%).

We’ve put a few examples below.

| Member | Nominated beneficiary(ies) and the amount | Valid or invalid? |

| Geoff | 100% to his spouse | VALID |

| Kristal | 20% to her 1st child

20% to her 2nd child 20% to her 3rd child 20% to her 4th child 20% to her legal personal representative (then distributed in line with her will) |

VALID |

| Mick | 75% to his sister, who is financially dependent on him

25% to his legal personal representative (to be distributed in line with his will to his brother who is completely financially independent) |

VALID |

| Stefan | 50% to his best friend

50% to his cousin |

INVALID – Stefan’s best friend and cousin are not ‘dependants’ under super law.

Stefan could nominate his legal personal representative to receive 100% and then update his will to include that his best friend and cousin were to receive 50% of his super benefit each. |

| Tim | 30% to his 1st child

30% to his 2nd child 30% to his 3rd child |

INVALID – Tim’s nomination doesn’t add to 100%. |

If your life changes…

A nomination will remain valid for 3 years. Towards the end of that timeframe, we’ll write to you to remind you to re-submit your nomination.

But we know that things do change, and you can change or cancel your nomination of beneficiary at any time. Just complete the nomination of beneficiary form with your new wishes, have it witnessed and send it through to us.

It is very important, however, that you keep your nomination of beneficiaries and your will up-to-date as your circumstances change.

If you have an Income Stream, you have another option

If you have a Retirement Income Stream, you may choose to nominate your spouse (or another eligible person) as your reversionary beneficiary.

Nominating a reversionary beneficiary allows that person to continue to receive your Retirement Income Stream as an ongoing pension payment, rather than as a lump sum on your death.

This could benefit them if, due to their age, they aren’t able to re-contribute a lump sum back into super. It allows them to continue to receive a regular pension from super, as a result, without stressing about what to do with a lump sum at what is already a pretty stressful time for them.

A reversionary beneficiary overrides any Binding Death Benefit Nomination you may have in place. It’s only Retirement Income Stream members who can set up a reversionary beneficiary.

See the Reversionary Beneficiary form for more information.

Note: Nominating a Reversionary Beneficiary is only available to Retirement Income Stream members, not to Transition to Retirement (TTR) Income Stream members.

Want more information?

If you want more information about nomination of beneficiaries, give us a call on 1300 307 844.

We suggest you consider getting professional legal advice around your estate planning needs. This can be a very complex area and laws and requirements do change from time to time.

Please note: the definition of a beneficiary for super purposes is different to the definition of beneficiary for tax purposes. Your super beneficiary may, therefore, pay tax if not also a beneficiary for tax purposes. See the ATO website for information about beneficiaries under tax law.