You may think that a percent or two doesn’t matter much, but when it comes to super, being in a well-performing fund makes a difference. Even something as small as 2% can make a big difference!

An example

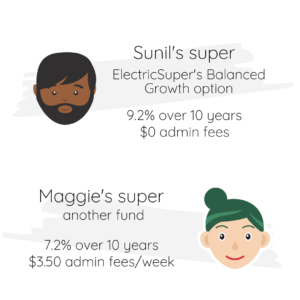

10 years ago, Sunil had $50,000 in his super account with ElectricSuper. Maggie had $50,000 in another super account with another provider.

To compare apples with apples, let’s assume Sunil and Maggie both received $5,000 a year from their employer into their super and they both have insurance in their super which costs them $250 a year.

The difference between returns for Sunil’s and Maggie’s super accounts looks small – just 2% between them. It doesn’t sound like much, but let’s see what a difference 2% can make…

After 10 years

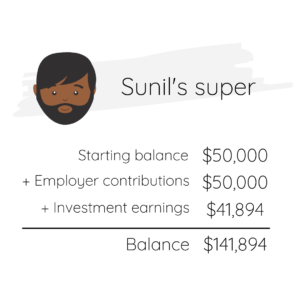

After 10 years, Sunil’s ElectricSuper account balance is $141,894. That’s over $41,000 of investment earnings.

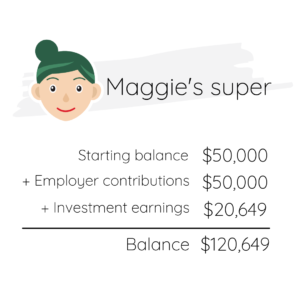

Maggie’s super fund has returned her just $20,649 in earnings over the same period. That’s less than half the amount Sunil made in ElectricSuper!

The difference 2% makes

If a 2% difference in returns (plus fees) can make such a difference in just 10 years, imagine what difference a lifetime with an extra couple of percent could make! Being with a well-performing super fund can make a real difference to the lifestyle you can live in retirement. Get it right and Future You will thank you.

If you aren’t sure if you’re in the best investment option for you, call our Helpline on 1300 307 844 for help or log into the member online portal to check your Investment Profiler.

And, of course, you need to keep in mind that past performance is not a guarantee of future performance and the 9.2% average achieved by ElectricSuper over the past 10 years (to 15/08/21) is above the target return. See the investment returns on ElectricSuper’s different options on the Investment performance page.

*Assumptions: insurance premium: $250 per year, investment fees: 0.69% per year, inflation 2.1%, improvement in living standards 1.1%

This article does not take your personal circumstances, needs or financial situation into account. It is provided as a general example only. Please consider seeking further advice before you take any action regarding your super.