Almost everyone has at least a vague notion of the age they’d like to retire.

But, in the 2022-23 year, the average Australian retired at just 56.9 years old. This is well short of the intended average retirement age of those working in electricity services industry, which is 65.1 years old. Almost a decade younger!

Why would someone retire so many years earlier than their intention?

It’s great if you are lucky enough to be in the 34% of retirees* who finish working because you can access your super or you choose to finish work to take up leisure activities, return to study or to holiday.

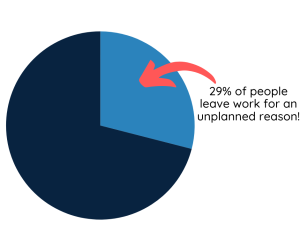

But what if you’re in the 29% of people* who either lose their job through retrenchment, dismissal, because no work was available, because you couldn’t find a job with suitable working arrangements or you have to leave to care for others. That’s right – nearly a third of those who retire leave the workforce because of an unplanned situation!

If you leave work years earlier than planned through a change in your circumstance, it can throw a spanner into your plans.

* Australian Bureau of Statistics 2022-23

What can you do if you have to leave work early?

First things first: Look at your current financial situation. Are there expenses you have that you could reduce or postpone for now if your income is reducing? What debt do you have? What position are your savings and investments in?

You might choose to engage a financial counsellor or financial adviser to help you work out where you are and what your financial situation may be in a few months or years. There are plenty of support resources around that could help you – some of them are at no cost or low cost. See the SA Government’s page on financial advice and counselling for details of different financial counselling services.

Once you know your current situation (debt, savings, super, any other income) you can look at your current cost of living. Writing a budget sounds boring, but this is an important step. The Australian Government’s MoneySmart site has a few tools to help you work out where your money goes. You can save it as you go, so you don’t need to have everything to hand to get started. They also have tips on how to write a budget and track your spending. Again, if you engage a financial counsellor, they can help you with this process.

Getting financial support

When you leave work, you will need to think about other ways you will support yourself financially if you don’t have income already lined up from another source (such as living on your spouse’s income together, income from investments or something else). Here are some options:

Disability Income Benefit Insurance

If you stop work due to your own illness, injury or disability, are under 60 and have Disability Income Benefit Insurance (Income Protection Insurance) through your ElectricSuper account, you may be able to lodge a claim for Disability Income Benefit Insurance. You can read more on the Disability Income Benefit Insurance page.

Employer Support

Depending on your employer, there may be support available through an employer program. Some employers offer financial support if you can’t work due to illness, injury or disablement. Speak to your HR team to find out more about what, if anything, they offer.

You may also have long service leave, which you could potentially take at half-pay, annual leave or sick leave that you could access to help you cope financially. Depending on your employer, you may also have other types of leave available to you or you may be able to cash out some of your leave.

Your employer may also be able to offer you a part-time or more flexible working arrangement, rather than you leaving employment completely. Speak to HR to find out if a more flexible option will work for you and your employer.

If you are made redundant, a redundancy payment may be made to you. Financial advice may be appropriate to help you manage this lump sum.

Services Australia

You might be eligible for government support or assistance. Depending on your situation, there could be a benefit to help you – and possibly sooner than you think. For example, you can start your JobSeeker Payment claim up to 13 weeks before your circumstances change! If you have a disability, there are different payments and services to consider. Visit the Services Australia website for more information about government benefits that you may be eligible for.

There are also Carer Payments that you may be able to apply for if you are caring for someone else, and the Age Pension is something to consider once you reach age 67.

A reverse mortgage or home equity release

If you own your own home, you may be able to borrow against it using the equity in your home. There are risks involved with this, which include the long-term impact on your finances, as well as different eligibility conditions that you would need to meet. You can read more about ways to use your home on the MoneySmart website.

The MoneySmart website also includes information about how and where to get financial and legal advice if you are considering this option.

Accessing your super

You need to be aware of when you can access your super. You don’t have to access it straight away, especially if you have other options that will work for your situation. However, it’s worth knowing that ElectricSuper members may be able to access their super from the age of 55. Other super funds will typically only allow you to access your super from age 60. While there is additional tax to pay if you access super before age 60, it is nonetheless an option to our members.

If you want to learn more about accessing your super, you can speak to our Member Services Team. Appointments are free for members. We can talk you through the options. Book your appointment at www.electricsuper.au/meet-with-us. Your spouse or a friend is welcome to come with you if you wish.

Remember that the earlier you access your super, the earlier it is likely to reduce or even run out.

Think about your time

Once you’re not at work anymore, you’ll need to think about how you’ll use the hours you previously spent at work.

You might not be able or willing to spend as much cash in your early retirement to keep yourself busy as you might have done if you’d retired later in life (with a larger super balance). Obviously, the earlier you start dipping into your super (or other savings), the longer the money has to last.

But there are lots of low-cost or no-cost activities you can get involved in. Community groups and volunteer groups are great ways to stay social without a huge financial outlay. You can read more about different groups and ways to spend your time on the LiveUp website. LiveUp has a quick questionnaire where you can answer a few basic questions. It will then deliver you a list of tailored resources in your local area.

At the other end of the scale, if you’ve left work to care for someone else, you might not have a lot of spare time, but you still need to make sure you take some time regularly to do something that you enjoy and that gives you a chance to relax and refresh. The LiveUp website can provide you with resources and groups that might be able to help you. CarersSA Australia also has support resources for carers, including counselling, coaching, peer groups to talk with, respite options and more.