It can be really hard to know if the decisions you’re making now for your super are the right ones. Are you building the future you want. It’s tricky to know what Future You will want or need. If only you could speak to someone who’s been there and done that.

We asked a handful of our members who are retired, or close to retirement, what they wish they’d known earlier. It’s the opinions and ideas of a few people, but they might help you to hone your own thinking. These ideas might help you decide what you want to focus on and some basic steps you could choose to take to get your super in order.

Idea #1: Make contributions now

Most people who responded to our questions would advise their younger selves to put small amounts into their super early. For example, if you’re 30 years old, $15 a week could equal $60,000 by retirement!

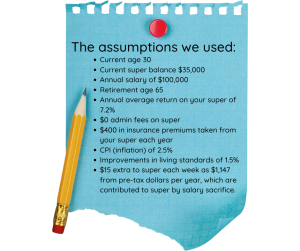

If you’re 30 years old now, with $35,000 in super and an annual salary of $100,000 now and you choose to put just $15 a week extra into your super, you could potentially end up retiring at 65 with an extra almost-$60,000 than you’d have otherwise. That $15 a week you’re setting aside now could buy you an amazing around-the-world trip at retirement, a new car or even just boost your weekly spending in retirement. See the assumptions we used for this calculation at the bottom of this story.

If you want to read more about the different types of contributions you can make to your super, visit our Contributions Page. There are different limits on the amounts you can put into super each year (which may also include the amounts that your employer pays in for you). You need to be aware of these before you start making additional contributions to your super. The ATO updates this information each year on their Contributions pages.

Idea #2: Chat to us

As an ElectricSuper member, you have access to our Member Services Team at no cost to you. You can ask our Team any questions you have about your super and situation. We can’t give you advice, but we can help you understand the facts and all of your options.

Most of our respondents said that they would recommend a chat with the Member Services Team.

You can meet with us in person, over the phone or by videoconferencing. We also come to remote and regional locations to meet with our members at worksites.

There’s no such thing as a silly question – if you want to know the basics such as what super is for and how much your employer is required to pay into your super, we’re here for you! If you want to know more complex information, such as the different asset classes your super is invested in, we’re here for that too. Just ask!

Idea #3: Get educated

As early as you can, get an understanding of super. Open your statements when you are emailed about them each year – and read them! If there’s something you don’t understand or that confuses you, just give us a call. Understanding your super as early as you can, means building your knowledge for a better understanding of your financial situation, both now and in the future.

Insurance

You may be paying for Death, Total and Permanent Disablement, and Disability Income Benefit (Income Protection) insurance. Do you have insurance cover through your super? How much is it for? Would it cover your needs if something was to happen? You can read more about life insurance and how to calculate your needs on the Australian Government’s MoneySmart website.

You can also talk to an adviser, free of charge, by calling our Helpline on 1300 307 844.

Investment

What investment option is your super invested in? If you’ve never made a choice, it will be invested in the Balanced Growth option. You can read more about the Balanced Growth option on our website. There are a lot of terms on there that you might not be familiar with. Terms such as “minimum investment timeframe”, “volatility scale” or “medium growth”. If you aren’t sure what it’s all about, you can give us a call and ask. It’s what we’re here for!

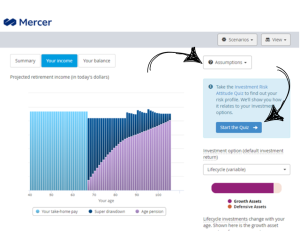

You can also check that you are invested in the best investment for your objectives and your tolerance for risk. There is a Risk Profiler in the Online Member Portal, or you can access it through the online Retirement Planner Calculator – click straight through to the “Assumptions” button and choose “start the quiz”.

If it’s too much, chat to one of our Helpline advisers, free of charge, by calling 1300 307 844.

Your balance

While it’s great to know how much you have in your super and to watch it grow over time – what does that number actually mean? You can use our quick calculator to check if you’re on track for a “comfortable retirement”. Type in your age and super balance and get a yes or no as to whether you’re on track.

A “comfortable retirement” is as per a standard prepared by the Association of Superannuation Funds of Australia and it’s updated each quarter. It is a guide for homeowning people as to how much they could expect to spend at retirement. It is broken down into how much you might expect to spend across different categories, such as entertainment, food, transport, health and more. Knowing if the lump sum you have in your super is on track to give you a “comfortable retirement” is much more useful than simply knowing what the lump sum balance is.

If the calculator shows that you’re not on track to hit the “comfortable standard”, there are tips to help you boost your super right there on the results page. Or, it may show you are well above the standard, or perhaps you don’t want to live the “comfortable standard” and are happy to live on less in retirement – both of which are fine options, if that’s what suits you.

However, knowledge is power. So knowing what your balance is and what that means for your retirement can give you a great knowledge boost.

Assumptions used in our calculation above: