During a downturn in investment markets, it’s normal to feel nervous about your super balance dropping. Many people worry when they see negative returns and question what might happen next.

Diversified

If your super or income stream is invested in the High Growth, Balanced Growth or Conservative Growth option, it means that your money is invested across a range of different types of investments.

(If you’re in the Cash option, your super is not invested across different investments and is invested only in cash.)

These different types of investment could include Australian shares, overseas shares, property, bonds, cash and more. Having your super invested across a diverse range of investments like this can potentially provide some protection for your super.

This is ‘diversification’. Having a diverse range of investments can help you better manage a downturn by spreading your super across different markets. This is because when one type of investment (for example, shares) is not performing so well, another investment type (for example, bonds) could help to balance that out by providing more solid returns.

Find information about how each investment option is invested into the different investment types on our website.

Risk and return

Each investment option is designed to deliver a different level of risk and a different potential return.

For example, someone invested in the High Growth option, which is a high risk/high return option, could reasonably expect to see a negative return more often than someone invested in the Conservative Growth option, a lower risk/lower return option. On the flipside, though, someone invested in High Growth could also reasonably expect to earn a higher rate of return than someone invested in Conservative Growth, over a longer timeframe.

Along with the projected frequency you can expect to see a negative return in each investment option, each option has a published return that it’s aiming to deliver. The published return target states the percentage we’re aiming to provide to members and over what timeframe. The Balanced Growth option, for example, aims to return CPI + 3% over rolling 10 year periods. For this, we firstly average the CPI out over 10 years. So, to give you an example, in a situation where CPI over the last 10 years is an average of 2.5%, the aim of the Balanced Growth option would be to provide members with 5.5% returns on their investment. That is, 2.5% (the average CPI over 10 years) + 3%.

Using averages

So, you can see that the average CPI is used when crafting the target returns.

On top of that, the expected return targets themselves are also averaged out over the year. If your option is aiming to deliver you CPI + 3%, that’s an average. It doesn’t mean that every fortnight or month will deliver you with exactly CPI + 3%. Some fortnights, months and even years will be under and some will be over. In fact, in some periods you will see a negative return.

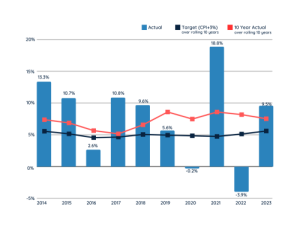

This graph shows you the actual returns for the Balanced Growth option between 2014 and 2023. You can see that there are a couple of years of losses in the decade, and a few years of returns over 10%. One year even returned 18.8%! However, the red line on the graph shows the 10-year average that was delivered for this option. You can see that, although this line does move up and down, the average fluctuates a lot less than the returns in each individual year.

You’ve probably heard super described as a ‘long term investment’. It’s true that money in the superannuation system for a typical working lifetime will weather many ups and downs. Over the longer term, you will end up, on average, coming through the downturns and maybe even seeing them as not much more than a blip in your history.

Timing is important

That said, timing can be vitally important. You could accidentally ‘lock in’ losses if you change investment option, or move to an income stream, while the market is low because you either don’t or can’t wait for the market to recover.

If you are approaching retirement, we recommend you speak to your financial planner. This can help you understand the potential impact of moving your super into an income stream (or withdrawing your super) during a period of lower returns. There could be negative outcomes if you move at the wrong time. Getting good professional advice can help you work out the right time for you to retire. You can make a more informed decision when you have all the facts.

Staying the course, but no guarantees

If you can ‘stay the course’ in your chosen investment option, history shows that investment markets can recover over time.

However, there are no guarantees with regard to superannuation and past performance isn’t a guarantee of future performance.

Note: the information and data in this article refers to the ElectricSuper Balanced Growth option for the Accumulation (Division 5) Scheme. You need to do your own research to determine if the information is relevant to you. We recommend that you speak to a financial planner before taking any action with your super or pension.