It’s a great question to ask, but whether you should get a financial adviser will depend on your own situation, needs, expectations. There are some key considerations that could help you make this decision for yourself. Let’s have a look.

What’s your situation?

The most appropriate financial information services to help you will depend on:

- what you want to know about

- your current and expected financial situation

- your relationships

There are many people around who can give you help and information:

- ElectricSuper’s Member Services Team

- Services Australia (Centrelink)’s Financial Information Service Officers

- Limited no-cost advice from ElectricSuper (or your spouse’s super fund)

- A financial adviser

You may be best supported by a combination of these services, or maybe just one of these services will be enough to meet your needs now.

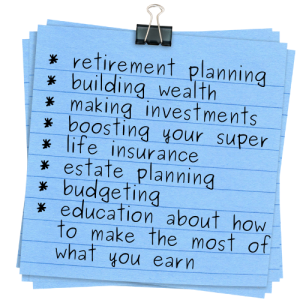

What can an adviser help with?

ElectricSuper’s Member Services Team and the Services Australia Financial Information Service Officer can give you facts and information, but they can’t give you advice and tell you what they think you should do.

An adviser, however, can give you facts and information and recommend the things you should do to achieve the goals you’ve discussed with them, based on your situation.

They can tell you what they think you should do and they can help you implement the recommendations they make. He’s a table to help you work out who can give you what kind of information, advice and service:

| Can give you: | ElectricSuper’s Member Services Team | Services Australia’s Financial Service Officer | ElectricSuper Helpline Adviser | Financial Adviser |

| factual information about your ElectricSuper account | ||||

| factual information about Government benefits, including the age pension | ||||

| an understanding of the ElectricSuper Income Stream pension | ||||

| advice on investment in super, insurance in super and contributions to super | ||||

| help with investments outside of super (information and advice) | ||||

| help with estate planning (information and advice) | ||||

| help with building wealth (information and advice) | ||||

| help with budgeting advice on making the most of what you earn | ||||

| Does the service cost? |

Case Study #1: Confident

Miles and Vicky are 60 years old, have no kids and are planning to retire in the next 5 years.

They start by meeting with the ElectricSuper team. The team helps them understand their super situation as it stands and outlines some of the options open to them, relating to their super now and when they retire.

They have no ‘spare’ money or assets to worry about and they’re happy with the information they get at their meeting about how they manage their super in retirement. They don’t think they need or want advice because they’re happy with the choices they are making for themselves.

They will chat to the Services Australia team when retirement gets closer, to understand what government benefits might be available for them.

Case Study #2: Uncertain and lots of questions

Phuong and Franklin are 60 years old, have 3 adult children and plan to retire in the next 3-ish years.

They meet with ElectricSuper’s Member Services Team. Here they get factual information about their options with super now and when they retire. For them, this includes asking, and getting information about, how an ElectricSuper Income Stream works.

At retirement, they want money for home repairs and to travel, as well as to give some to their kids. They want to pay off the house and they are nervous about tying too much up in investments. They want to know how much they should invest into an Income Stream product (and if that’s even the right thing for them), what they should keep in the bank and what happens to their eventual age pension if they gift money now. They also want to know if there’s a better option for their cash than the bank. On top of that, they want to leave a financial legacy for their children and grandchildren.

They are nervous about what happens if they put their super savings into a retirement product and choose the wrong investment option.

Their situation is somewhat complex plus they want guidance to help them make decisions.

For them, meeting with a Financial Adviser after meeting with ElectricSuper’s team would likely be a big help. They will be able to get direction and advice on how to invest their money in different ways that suit them and help with estate planning.

Case Study #3: New to Australia

Tobias is 65 and plans to retire when he reaches 67. He arrived from South Africa 5 years ago and he’s single with no kids.

He isn’t completely sure how the retirement system in Australia works and doesn’t know much about super. He also doesn’t have much super, having only had a few years in the super system.

Tobias meets with the ElectricSuper team to get an understanding of his super and his options. He also meets with the Services Australia Financial Information Service Team to get a better grasp on the government benefits that might be available to him, when he can access what benefit and how to maximise any entitlements.

Tobias also chats to the ElectricSuper Helpline Adviser to make sure his super is in the best investment option for him and that he’s making the right kind of additional contributions to get the most he can from his super.

Case Study #4: Starting young and retiring early

Jacob is in his 20s and working at his first job. He wants to retire at as young an age as possible, but doesn’t know where to start with this dream.

Jacob chats to the ElectricSuper Member Services team to find out more about maximising his options within his super.

He also makes an appointment to meet with a financial adviser. He walks to the financial adviser about how he can save up a home deposit while also making investments outside of super.

The financial adviser works with him to make sure he has enough insurance to cover him if he is injured or sick and can’t work and the adviser talks him through why working out a budget could work for him.

Case Study #5: Investment question

Shelley has just joined ElectricSuper.

She wants to know if the default Balanced Growth option that her account is set up with is the best investment option for her.

She calls the ElectricSuper Helpline to speak to an adviser and they help guide her to making sure the investment option is the right one for her goals and her ability to cope with risk.

Case Study #6: Starting over

Martelle, aged 50, has recently divorced her husband. She feels unsettled with this change and feels some grief over the loss but she knows she needs to think about what the future might bring for her.

She speaks to ElectricSuper’s Member Services Team to work out what super balance she might have at retirement and what that means for her lifestyle will look like then. Using this information, she decides on her own steps to boost her super.

She also wants to start saving and making easily accessible investments to cushion her against any future unexpected bumps in the road. She wants help with budgeting and investing the funds she’s able to set aside. She makes an appointment to talk to a financial adviser who can help her with these goals.

Case Study #7: Caring and ill health

Colin, 74, and Penny, 83, are married and currently live together, but Penny’s care needs are increasing and she suffers ill health. She may need to go into an aged care facility.

They speak to a Services Australia Financial Service Officer to learn what government support is available for them and how separate living arrangements could impact on their financial situation.