Note that this article was written in 2021 and the ABS statistics around people’s motivations for leaving work and their ages may have changed from this story.

There are exceptions, of course, but most people plan to retire eventually.

Some people have a particular age in mind. Others plan to leave work once they have a certain amount in super. For yet others, their retirement date will be once they’ve completed a particular project or piece of work And, for some, it will be once their partner is also ready to retire.

Whatever it is that you think will launch you into retirement, consider that many people retire before they planned to.

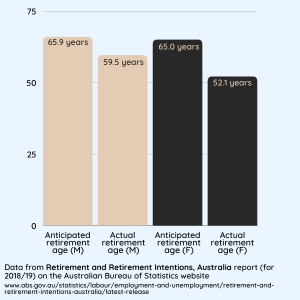

In fact, the difference between the age the average person plans to leave work and the age that the average person actually does leave work is as much as 13 years earlier for women and 6 years for men.

That might sound confronting, but the good news is that just under half of retirees (46%) leave work because they are eligible to access their super. It means a great number of people are in a position where leaving paid employment earlier than planned is a positive choice, rather than something they are forced to do due to ill health or caring responsibilities.

It takes some planning and consideration to make sure your super is as ship-shape as it can be. Are you on track to get your super where you’d like it to be by the time you plan to retire? Or even earlier?

The earlier you retire, the longer you will spend in retirement so the longer your money will need to last.

Find out where you are

Our online calculator is a great tool that lets you see how long your money could last once you’ve retired. It allows you to vary different factors, such as an earlier retirement date, to see what difference that will make. It can also help you see what extra contributions to your super now can do for your lifestyle in retirement. You can test what drawing a larger or smaller fortnightly income in retirement could look like for you. You can also include your spouse’s details. The calculator incorporates the aged pension to give you a complete picture of your money in retirement. Give it a try now.