Starting a family and your super

*Note that this article uses assumptions from the 2021-22 financial year. The amount of super that your employer must contribute for you as a minimum has increased since that time and this would affect the outcomes. Compulsory parental leave and super on that may also have changed, which would further affect the outcomes shown here*

When you’re dealing with the ups and downs of your new family, the first words, the first steps, the first day at school, the last thing you want to be thinking about is super.

But it could be a great time to consider your financial future together and the baby steps you could take to make sure it’s all you want it to be.

If you or your partner are pausing the 9-5, the super the stay-at-home parent receives is likely to be significantly lower. It could (obviously) be as low as zero. Once you deduct ongoing fees and insurance premiums, their super could actually start to go backwards.

It doesn’t have to be that way, though. There are steps you can take to help ensure that your (or your partner’s) super isn’t derailed by the pitter patter of tiny feet.

What difference can taking a couple of years away from work really make?

What difference can taking a couple of years away from work really make?

Let’s have a look at some numbers.

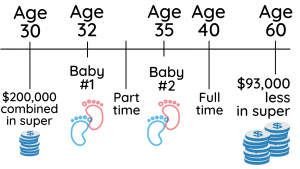

Let’s assume you’re both currently 30 years old, on the same $80,000 salary with the same $100,000 current super balance. Your first child arrives when you’re 32, with a second child when you’re 35. Let’s assume one partner takes a year off work with the arrival of each child. They then work part time (let’s assume 0.5 FTE) until the youngest starts school. The end result will be that your combined super balance at age 60 will be more than $93,000 lower at retirement than it would have been if both of you had continued to work full time right through.*

Start at work

Some employers offer financial support to their employees while they take time away for things such as the arrival of a child. It could be a regular salary amount for a certain number of weeks or a once-off bonus payment.

In some cases, the employers’ support will include payments into super. Check with your employer (or have your partner check with their employer) to find out what support they offer.

Then see what’s offered by the government

The Australian Government offers Parental Leave Pay for up to 18 weeks, subject to certain conditions. You can find out more at Services Australia.

The payments don’t include superannuation, but you or your spouse could put some of the money you receive from the government into super.

Look at your household’s super

On top of this, there are options available to help make sure that the superannuation in your household is as well-balanced and robust as possible. Let’s have a look at some of them:

An ElectricSuper Spouse Account

If your partner doesn’t have an ElectricSuper account, you can nominate for them to open one. As a Spouse Member, they will enjoy the same benefits you do, such as paying no admin fees, a choice of 4 great investment options and the opportunity to apply for Death and TPD insurance at competitive rates.

They could then investigate rolling their other super into the new ElectricSuper Spouse Account to reduce fees they are paying to other funds. Of course, as with anyone rolling money from one super account to another, your spouse will need to consider if rolling out of their other fund(s) is right for them. That will include thinking about what benefits (such as insurance) they would lose by closing the other account.

The ElectricSuper Spouse Account isn’t only a great option for paying no admin fees while your spouse is away from work. When your partner returns to work, they can give their employer the Standard Choice form and ask for their super contributions to be paid into ElectricSuper. Their account will then grow with regular contributions each pay day.

Contribution splitting

Another option available is that any ElectricSuper member can split some super into their spouse’s super account. It doesn’t matter which super fund that account is with.

You can split up to 85% of your pre-tax contributions to your spouse’s account. Pre-tax contributions are the contributions you receive from your employer (that is, the super guarantee payments they make for you) and any salary sacrifice contributions you make.

There is no cost to split contributions to your spouse’s existing super account (either with ElectricSuper or with another fund). While they’re away from work, it could be a great way to keep their super account active and growing.

See the form to read more about splitting your super to your spouse online here

And while we’re talking about sharing…

You or your partner could also think about making contributions to the super account of the stay-at-home spouse with after-tax money too. You don’t need to set up a formal arrangement.

There is sometimes reluctance to share super between spouses. After all, each of you has worked for your own super and the account is in your name alone. We respect that. However, remember that super is treated like any other asset in the case of a relationship breakdown.

If things do go sour, your super and your partner’s super will all be considered as assets of the relationship to be shared, just like the house, car and the vintage Nirvana vinyl LP collection.

Assumptions

- Growth investment returns (7.0%), percentage based fees $0, insurance premium $400, CPI 2.1%, improvement in living standards 1.1%